- How it works

- Marketing Tools

- Competitive Research

- Finra-reviewed content

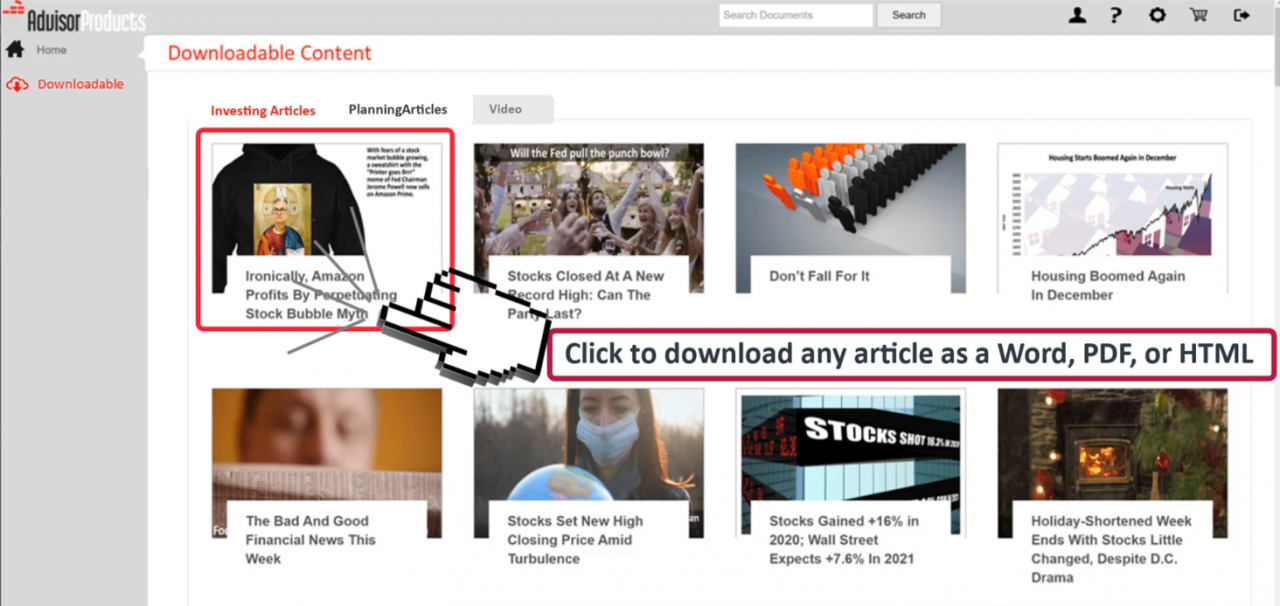

- Downloadable Content

- Advisor Education

- Advisor Websites

- Marketing Tips

- Crm Software Integration

- Search Engine Optimization

- Email Marketing Solutions

- Social media Marketing

- Advisor Marketing Videos

- Advisor Print Newsletters

- Advisor Lead Generation

- Expert Market Intelligence

- Branding and Print Materials

- Advisor Blogs

- Advisor Webinars

- Advisor Presentations

- Advisor Client Portals

- Webinars

- Advisor Google And Facebook Ads

- Advisor Public Relations

- About

- Resources

- Login

- Schedule A Demo

Advisor Blog

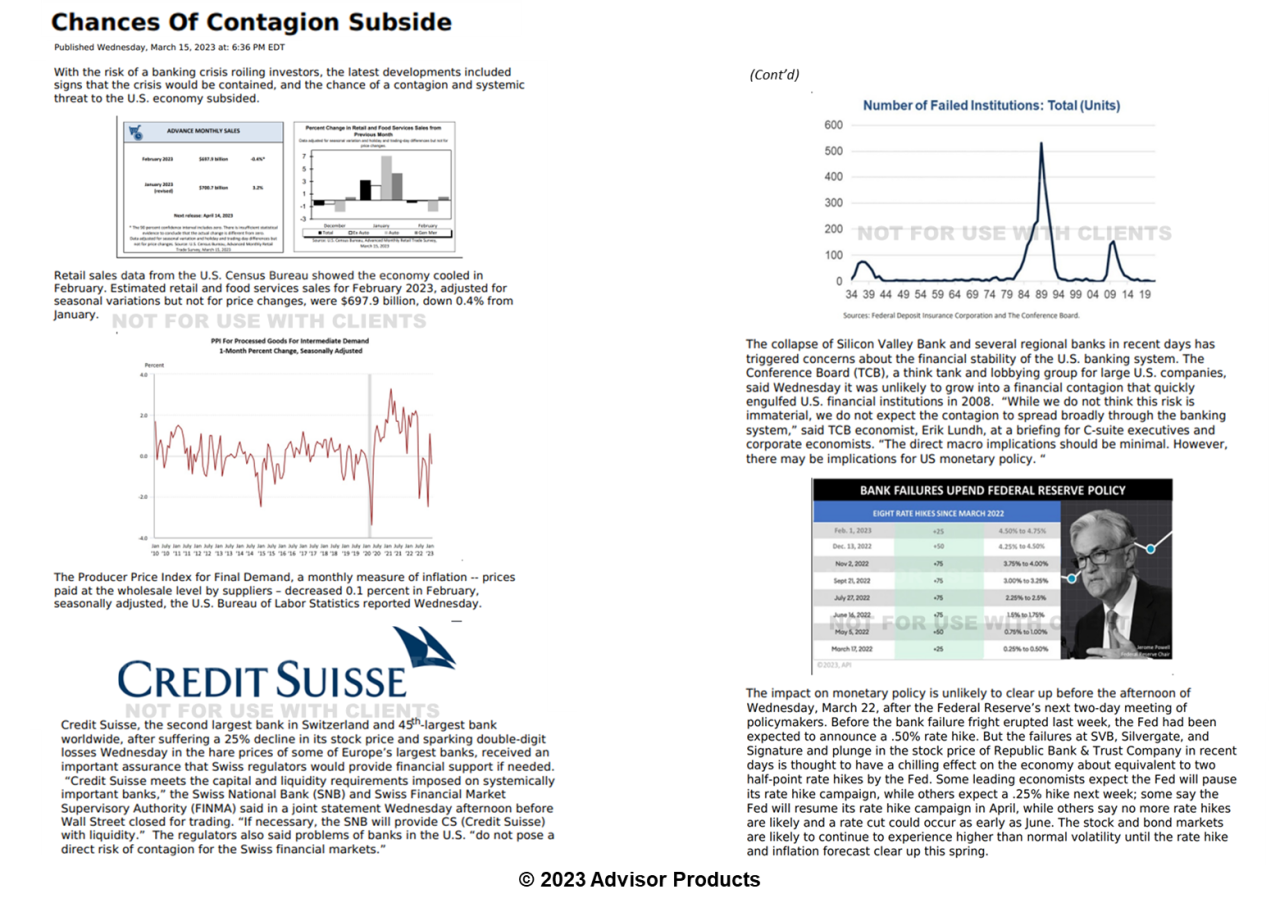

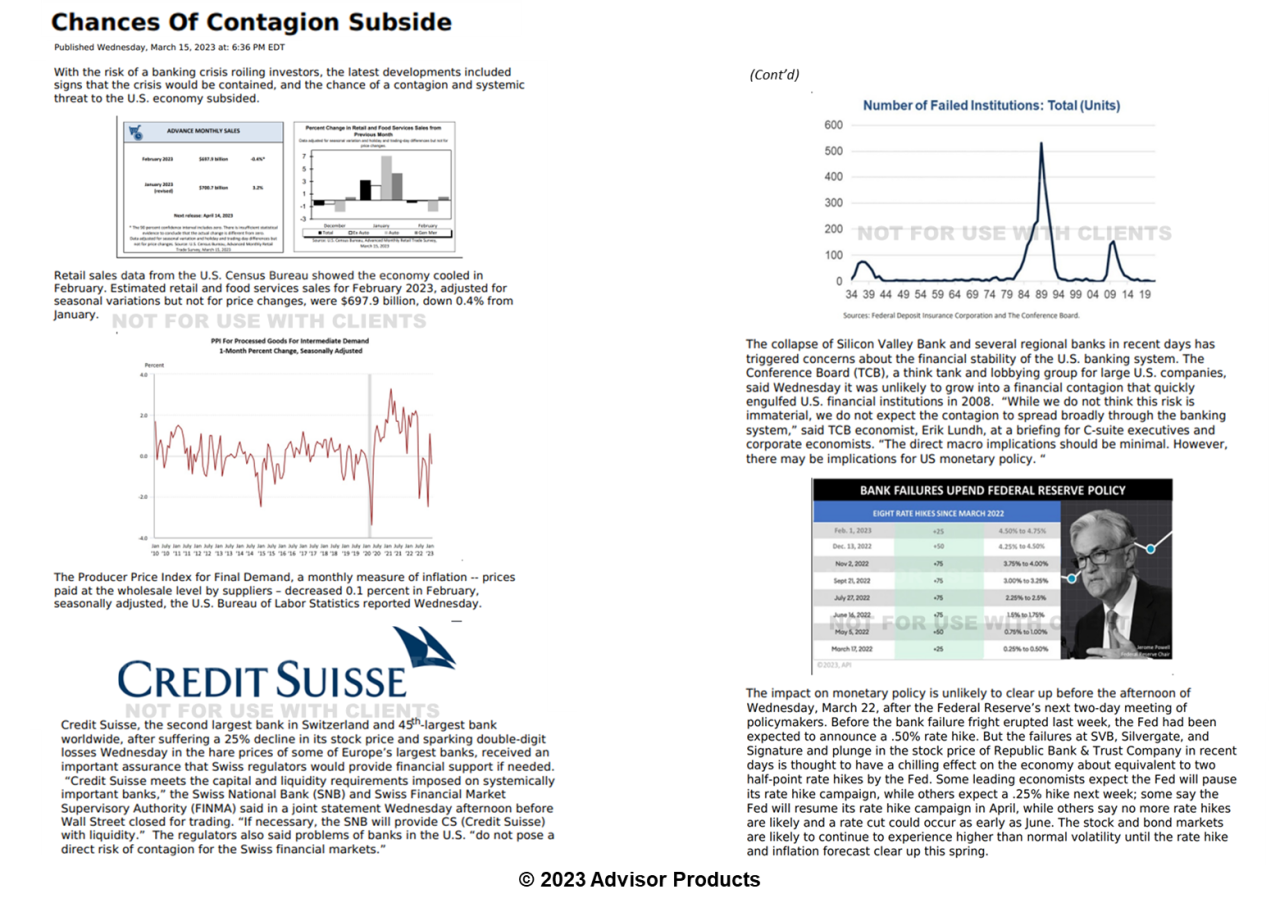

Bank instability in March added a new risk an outlook already clouded by inflation and monetary policy problems hobbling the post-pandemic recovery. The bank runs came on top of the inflation crisis caused since the pandemic of April 2020 and March 2022 Russian war on Ukraine. Heightened fears threaten to deepen the bear market that began in June 2022.

Uncertainty about the future is a constant, but when a new risk ignites a wave of fear, financial professionals must be able to respond immediately with analysis clients can’t find elsewhere. This is not so easy for independent professionals.

6743 Hits

6743 Hits

March 15 was one of the most pivotal days of the past 50 years, and financial advisors played a crucial role in getting the facts out about the banking panic to their clients and community. Trouble is, your messaging must be:

- as timely as WSJ, NYT, CNBC, and Bloomberg

- concise and smarter than the financial media

- centered on the financial and tax planning

- FINRA-reviewed

- consumable in a branded MP4 video, HTML or Word document, script, and tweet-ready

Advisor Products content stream feeds content to advisors that meets all of the criteria listed above.

3394 Hits

3394 Hits

A key concept to talk about with clients that practitioners often leave unsaid is that American exceptionalism is an investment philosophy.

In this video, the concept is explained. A video is just one way to explain this key concept. An advisor needs a script and graphics to go over this key concept with clients one-on-one in meetings, webinars, and blog posts. That’s what we do!

1790 Hits

1790 Hits

Here are the topics of FINRA-reviewed tax and financial planning articles we created for the past three months, amid one of the most difficult periods in modern American financial economic history.

1442 Hits

1442 Hits

Wall Street strategists are unreliable at predicting the closing price of the S&P 500 in the year ahead, but their 2021 forecast demonstrates just how wildly wrong the largest brokerage firms can be and how much it can cost investors.

For over a decade, Advisor Products articles and videos have documented Wall Street’s failure to predict the market, thanks to data from independent economist Fritz Meyer, who has tracked the predictions of 10 leading Wall Street investment strategists as published in Barron's every December.

3743 Hits

3743 Hits

If content is king, independent economist Fritz Meyer must be royalty.

Sharing thought leadership content is an optimal way to stand out for a financial advisor to standout, when communicating with clients, referral sources, and friends. Only because Advisor Products has a renowned independent economist on its team are we able to produce authoritative content like this video.

1990 Hits

1990 Hits

Certified Financial Planners™ and other professionals advising ultra-high net worth or income individuals (UHNWIIs) make many, many marketing mistakes. These 11, however, are common among professionals building a practice by advising a small number of UHNWIIs – the best and brightest advisors.

- Not sharing content. Sharing content on social sites, emails, websites, blogs, is a requirement of modern marketing for advisors.

- Sharing library articles. The rich really are different. So, CFP®, CPA, and other practitioners advising ultra-high net worth or high-income individuals (UHNWIIs) require a different approach, one targeted to individuals with at least several million of investable assets or an annual adjusted gross income of more than $400,000. UHNWIIs urgently – before the new tax law is finalized in the days ahead – urgently need to be alerted to bracket management opportunities under the pending tax bill, trust and gift strategies and the changes in ILITs. UHNWIIs continually need to be reminded of their investment policy statements, reasons they can trust you, and that educated financial consumers are your best clients.

- Little financial education. Almost all advisor marketing materials claim a commitment to client education. Few back it up with a stream of substantive financial news that UHNWIs cannot get from The Wall Street Journal, New York Times, or by googling “S&P 500.” Advisor Products’ Financial Advisor Marketing Engine 3.0 is an unrivaled solution.

- No written marketing plan. This mistake is quite ironic: While methodical about financials number crunching, CPA and CFPs almost always fail to write down a strategic marketing plan before investing in a website, PPC or SEO marketing campaign.

- Not sharing videos. According to the A.C. Nielsen Co., the average American watches about 28 hours of TV every week, equivalent to two months nonstop per year. Textual content is not as effective as video in reaching most people. Making engagement harder still, some people prefer charts and tables to text. Advisors need to share content on multiple mediums and social networks.

- Not requiring signing in or signing up. If you have are not making the four mistakes outlined above, then you have valuable evidenced based analysis to share, require signing up for your financial news alerts. While you can show the title and topic of every article along with the first paragraph or two, reading the full; text of articles should request signing in to your client portal filled with educational content updated regularly. Not requiring your users give you a name and email address undermines marketing success.

- Not integrating digital badges. The CFP Board, AICPA, CFA Institute and other professional designation organizations enable advisors to link back to a secure server to validate your credentials online. When you meet someone for the first virtually, share a link to your accreditation body digitally verifying your hold a credential.

- Not targeting UHNWIIs. CFP®, CPA, and other practitioners advising ultra-high net worth or high-income individuals require content marketing campaigns targeting individuals with at least a several million of investable assets or an annual adjusted gross income of more than $400,000.

- No Yelp Listing. Advisors should list on Yelp. However, don’t let an online advertising or SEO sales consultant convince you that Yelp is marketing-gold. Leads generated on Yelp may keep you busy with questions from individuals below your minimum, but UHNWIIs not so much.

- No follow through. Because communications for UHNWIIs about personal finance is complex and advisors are marketing experts, shiny objects – lately, Yelp, Facebook, LinkedIn paid ad schemes – may bring some leads but are not a permanent solution for client communications. Ultimately, content is king, and CFP practitioners need a stream of campaigns for UHNWIIs. Because learning enough to find the right solution with the right messaging takes time and then it takes even more time and patience to implement a strategy that will reliably return leads from UHNWIIs, advisors fail to follow through and get sold or sidetracked.

- Not building a list. If you’re not building a list continually, you will fail. Social and email list-building is a game of numbers. Actively building your list of emails, connections, and friends is a requirement of success. Highly targeted paid ads with content for UHNWIIs builds a list of fans who will contact you in two, three or five years. Budget $100 or $200 a month to build your list using PPC ads to find low hanging fruit.

929 Hits

929 Hits

The bond market expects inflation for the next decade to annually average 2.35%, based on the Breakeven Inflation Rate, a market-based measure of expected inflation derived from subtracting the current yield on 10-Year TIPS from the current 10-Year Treasury's yield

A negative real return on 10 year Treasurys is a tectonic shift for advisor clients, unprecedented in modern history!

1201 Hits

1201 Hits

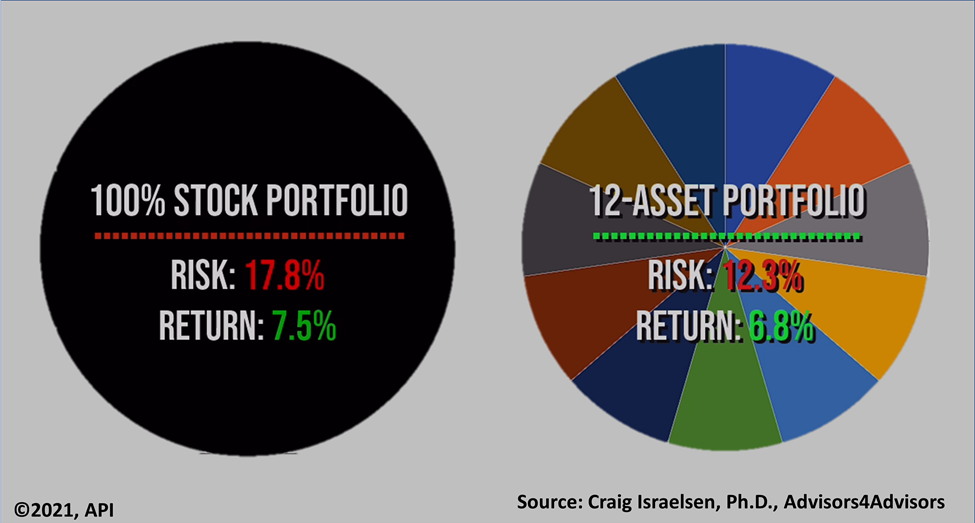

The commemoration of 9/11 and pullout of U.S. troops from Afghanistan marked the passing of 20 difficult years. Historians will debate the lessons to be drawn from this tumultuous time for decades to come. For investors, however, a crucial investment lesson to be drawn is clear: In the past 20 years, amid the tumult and difficulties, broadly diversifying paid off, and quite convincingly at that!

988 Hits

988 Hits

A rubric of advisor marketing is never market based on past performance, but this is an exceptional time.

919 Hits

919 Hits

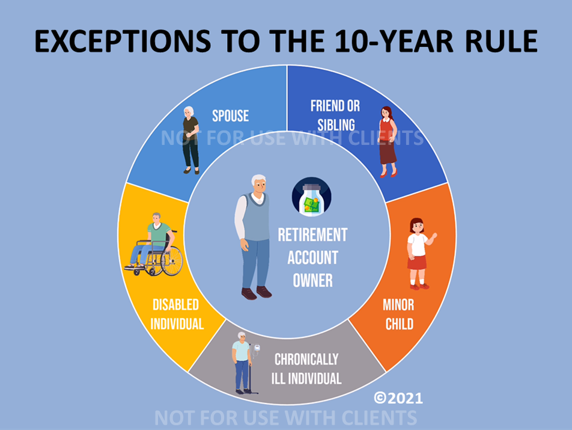

The Secure Act’s 10-year distribution rule on federally qualified inherited retirement accounts exempts widows, children, chronically ill and disabled individuals. They’re specified as “eligible designated beneficiaries” in the Secure Act.

1110 Hits

1110 Hits

With tax rates expected to be going up, and the stock market breaking records for 11 months, retirement savers should proactively investigate converting to a Roth IRA in 2021.

Are you alerting your clients and prospects that this to this tax-smart retirement investor move must get done by the end of 2021?

876 Hits

876 Hits

This week’s video breaks traditional rules of financial advisor marketing. It is long (four minutes). It’s also detailed, and it delivers bad news for wealthy people ,who are going to face much higher taxes in 2021.

Why are we breaking the rules? Because traditional financial services marketing is not what a an investment, tax, financial planning professional needs in this pivotal moment in financial history.

728 Hits

728 Hits

For the first time since the administration of President Ronald Reagan, federal tax policy is changing. You need to warn clients and friends, but how can you do it?

With Congress debating President Biden’s proposal for a massive increase in federal infrastructure spending, two observations by independent economist, Fritz Meyer, may make higher taxes easier to bear for your clients. Presenting facts and historical perspective is the right approach for financial professionals.

727 Hits

727 Hits

Financial advisor marketing is oxymoronic. Like jumbo shrimp, mini-strokes, and private clubs, it is not the way a fiduciary should approach external communications using modern tools. For private wealth advisors, a better way is to educate clients continually.

Financial consumers are bombarded constantly by ideas diverting them from the personal tax and financial planning strategy carefully crafted by you, the professional advice you authored to build a sustainable low-expense core portfolio and keep them in front of opportunities and pitfalls amid the first reversal in federal tax policy since the election of Ronald Reagan in 1980.

701 Hits

701 Hits

Whether you need a comprehensive content marketing dashboard to manage a private wealth advisory's external communications or just a monthly subscription to a thought leadership article you can download into Word weekly, Advisor Products Inc. (API) has a solution.

Integrated Marketing Solutions. API's marketing dashboard is a comprehensive content management system for private wealth advisors. Websites, newsletters, and social network posts are integrated with API content, automating marketing tasks for professional financial services firms.

745 Hits

745 Hits

One of this week’s financial planning articles is the subject of this 2½-minute video about our platform for advisors; it shows advisors how to generate the right leads.

Leads that are attracted to your firm for the right reasons are the right kind of leads. They are a small percentage of contacts who value your news stream about tax and financial planning.

671 Hits

671 Hits

Consumers are shown why it is crucially important to view financial news through a long lens of history in this 90-second video.

It not only tells investors about the value of a professional who knows history, but it also demonstrates it.

743 Hits

743 Hits

Following the advice of Wall Street’s best minds resulted in huge losses at key inflection points, and Wall Street's ability to forecast the S&P 500 is too unreliable to be helpful and not even close to accurate.

That's the conclusion of an independent economist who has tracked the predictions of Wall Street top strategists’ in Barron’s every year since 2007.

1029 Hits

1029 Hits

For the third time in 80 years, the Investment Advisers Act of 1940, advertising and sales rules were amended on Dec 22. 2020. RIAs are not required to comply with the new rules for 18 months. However, the new rules enable RIAs to use of testimonials and investment performance in marketing, provided you meet a more-explicit disclosure requirement. Growth-minded RIAs, within a couple of weeks, can start using the new rules to market using testimonials, third-party rating services, and performance.

Adopted by the Securities and Exchange Commission on Dec. 22, 2020, the new rules have practical implications for how advisors use LinkedIn, Yelp, and other social media. Books and recordkeeping rules also have been modernized.

728 Hits

728 Hits

The $325 billion in aid to business owners enacted into law is a good example of how Advisor Products is different from other marketing vendors. Our platform is built for delivering urgent important news to your clients, prospects and referral sources.

The platform is built to enable financial advisors to be better sources of financial news than mainstream media outlets. For example, by the time President Trump signed the $900 billion stimulus and relief bill on Dec. 27, 2020, a 50-minute presentation by Bob Keebler, CPA/PFS, was posted in our marketing dashboard for advisors to download. The transcribed presentation by one of the nation’s leading tax educators includes 60 slides. Bob Keebler’s slide cost just $600 a year and is one small part of the Advisor Products content marketing dashboard.

832 Hits

832 Hits

Yes, facts still do matter! In its Q3 2020 financials, The New York Times reported surpassing seven-million paid subscribers in October.

Even in this difficult stage of the information explosion -- a post-truth world -- people value good journalism. They'll even pay for it!

962 Hits

962 Hits

In advising business owners, professionals, and intergenerational family wealth, CFA®, CFP®, CIMA®, CPA, and other professionals have an obligation to educate their clients about tax and investment strategies. It’s just the right thing to do, if you're a fiduciary doing what's in your clients' best interest.

This approach is very different from traditional advisor marketing. It is what we do. Advisor Products provides communications for private wealth managers. It's totally different from other advisor website companies.

798 Hits

798 Hits

This video shows the power of educational content to advisors to the mass affluent, professionals who aspire to advise a practice of 10 or 20 ultra-high-net-worth families.

Videos can be narrated by you using a proprietary tool. It's not hard. Most advisors prefer the professional voiceover.

759 Hits

759 Hits

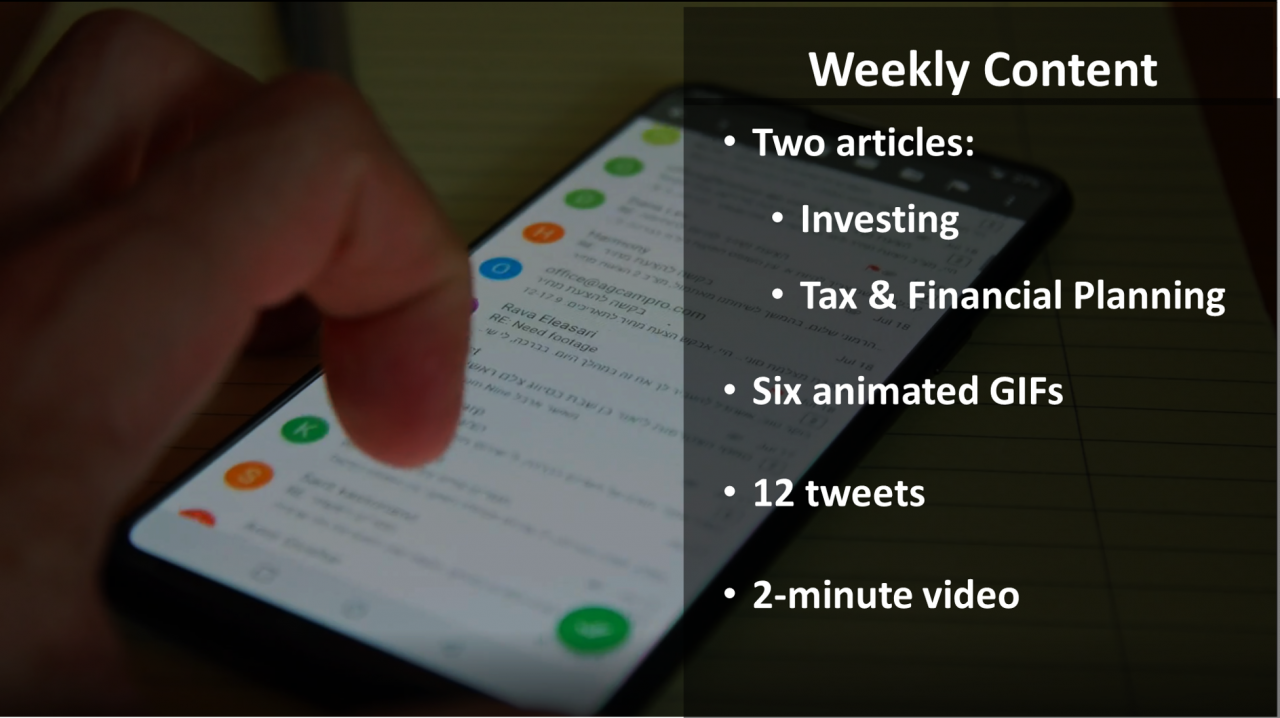

FINRA-reviewed videos from Advisor Products are timely and intelligent. Check out the one below, which shows you exactly what we do every week.

For RIAs advising business owners, professionals, corporate managers, and other individuals likely to value learning how to manage their money better, this is a highly customizable solution. You can actually narrate over our videos, if you have the attention span.

851 Hits

851 Hits

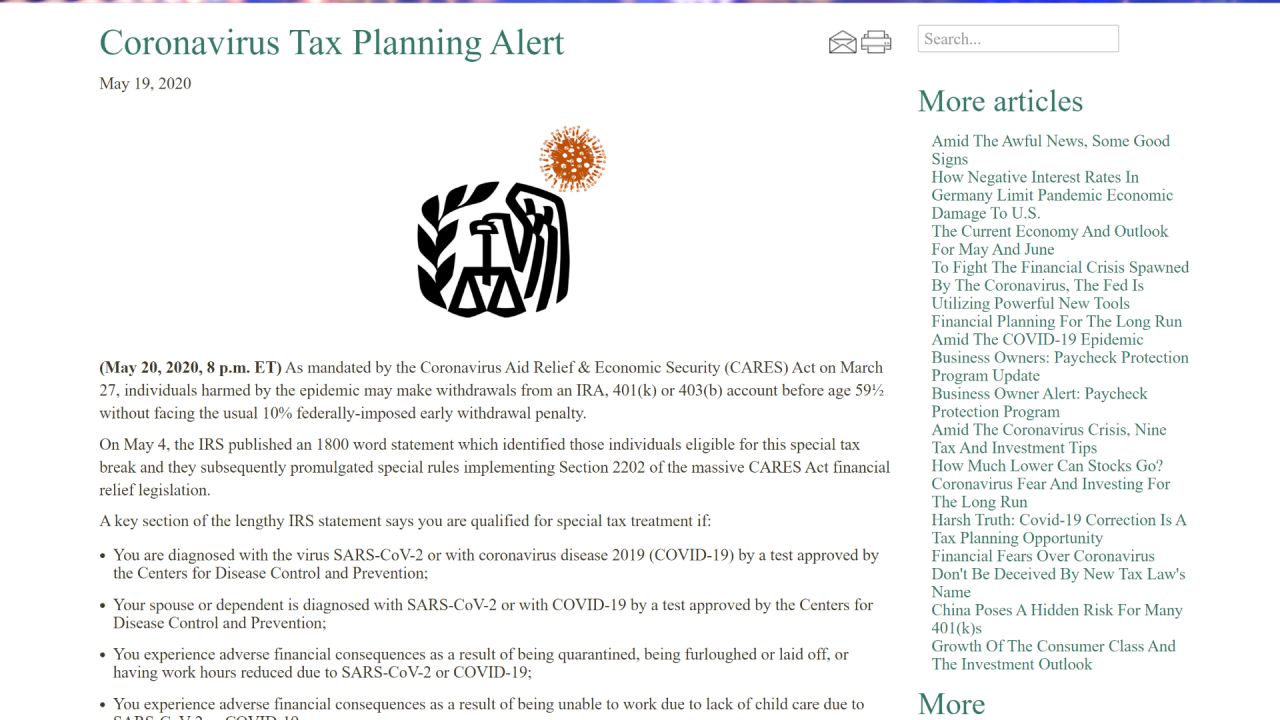

Advisor websites with coronavirus tax planning alerts are our niche in marketing.

Educating investors with financial news for consumers makes the best marketing campaigns for RIAs, but is hard to do because advisors need real financial news writers and not marketing fluff.

1178 Hits

1178 Hits

A mantra of independent economist Fritz Meyer in continuing education classes on Advisors4Advisors is that, "Ultimately, earnings drive stocks.

Here's a three-minute investment advisor video explaining the earnings outlook amid the pandemic.

Our content is easily plugged into any WordPress website by your webmaster or our tech staff.

1045 Hits

1045 Hits

(Wednesday, May 6, 2020, 12 p.m. EST) Last Thursday, Fritz Meyer gave me a seven-minute update on the new inflation data, and it blossomed into the video below about the Paycheck Protection Program for business owners.

This video addresses business owners who have not applied for PPP. These are entrepreneurs who probably never applied for government aid before and may be reluctant to do so now, even though they legitimately qualify and need it.

1315 Hits

1315 Hits

A deluge of new federal tax breaks is about to pour forth and flood Americans again. Only 15 months ago, SECURE Act massively changed rules for retirees, and only one year before that, TCJA rewrote the tax code entirely. This is the third major tax reform in three years!

On April 2, at 4 p.m. EST, Bob Keebler’s class focuses on the tax breaks advisors need to know about under the $2 trillion stimulus plan and the avalanche of tax rules about to hit.

1231 Hits

1231 Hits

2020 started with SECURE Act’s idiosyncratic impact. Then Covid-19 hit, which has caused a sharp correction in stocks. It’s certainly shaping up to be one of the most turbulent times in the history of tax and financial planning.

1468 Hits

1468 Hits

At a two-hour, two-credit continuing professional education webinar three weeks ago about key fundamentals driving portfolios now, Advisor Products' resident economist, Fritz Meyer, received a 9.7 rating on a 10-point scale.

This 32-minute video also contains links to additional information on key topics discussed.

1641 Hits

1641 Hits

The best marketing content for financial advisors draws UHNWIs and the mass affluent by offering tax and investment tips that actually save thousands of dollars.

1727 Hits

1727 Hits

The signing of the SECURE Act on December 20, 2019 leaves only a few days to act on implementing major tax savings. A call to action targeting four tax-saving pre-retiree and retiree situations is available to subscribers to our weekly feed for consumers. It shows how to attract wealthy pre-retirees and retirees by offering smarter tax and investment planning techniques in a news feed.

2809 Hits

2809 Hits

It’s unlikely you’ll see this 2019 year-end tax tip in the financial press, and it has not in the trade press currently. However, as a CFP®, CPA, CFA, CIMA® or retirement-income professional, this is probably the best 2019 year-end strategy for building your reputation as a thought leader. It's a substantive way to engage clients and prospects who are thought leaders in their chosen fields.

2749 Hits

2749 Hits

A day after third quarter 2019 ended on Tuesday, October 1, the video below was posted to advisor YouTube channels that we create and embed in advisor websites, advisor newsletters, and tweets for advisors. It's automatically posted with branding on advisor websites.

3127 Hits

3127 Hits

The big news from economist Fritz Meyer's CE webinar on Advisors4Advisors on September 10, was his analysis of how negative rates in Germany are driving down bond yields in the U.S.

3159 Hits

3159 Hits

Negative interest rates in Europe are a new and unprecedented financial economic condition advisors must suddenly navigate.

3590 Hits

3590 Hits

2595 Hits

2595 Hits

If retail sales climb skyward and no one sees, it still causes a boom. Like the proverbial tree no one sees falling in a forest, the growth in retail sales has a real impact -- after inflation.

Fritz Meyer had a hunch that something did not add up. Retail sales releases month after month have been okay, but based on decades of experience, Fritz knows that inflation often masks real activity. So he built a spreadsheet adjusting for inflation the Census Bureau's retail sales data releases. It revealed a story that the financial press month after month have been missing. Fritz stepped me through his analysis last Friday. As always, he summarized it in a chart.

3371 Hits

3371 Hits

Advisor email newsletters often never make it to the intended consumer's Inbox. They go to junk, spam, or clutter folder. What can you do to fight back? Here's the answer.

3380 Hits

3380 Hits

Systematic client communications for advisors is like multi-level chess. Content must be thought leadership, concise, and in the medium each individual client prefers. We do all that, while also enabling advisors to personalize everything by editing tweets, emails, and articles and narrating videos.

4061 Hits

4061 Hits

Advisor Products no longer publishes articles, videos and other content on websites for consumers to view unless they provide an email address. Why?

We post articles on advisor websites twice weekly in addition to a weekly video, all of it based on monthly continuing professional education webinars by Fritz Meyer, Bob Keebler, and Craig Israelsen on Advisors4Advisors.com. Advisor Products content valuable to any investor, but it's extremely valuable to UHNWIs, HNWIs and mass affluent individuals.

4215 Hits

4215 Hits

This email newsletter is unique. It's based on continuing professional education webinars taught every month by Robert Keebler, CPA/PFS, who has educated legal and accounting professionals about individual taxation for over three decades.

4684 Hits

4684 Hits

Every week, a new script illustrated with charts, tables, and graphics is posted in our dashboard.

Record your own MP3s and upload the slides to give you own version. Use just one slide slide, edit the text and make your own videos or newsletters.

4399 Hits

4399 Hits

Having built a very successful practice for three decades, the advisor on the phone was sure he would not use a dashboard for communicating with clients and influencers. He delegated creating newsletters and client communications to his staff.

Seemingly oblivious to the revolution in building trusting relationships on the web, this mindset is common among older advisors, and it makes them increasingly susceptible to competitors who understand financial advisor technology. A 30-something or 40-ish CFP, CIMA, CPA/PFS, CFA, who grew up texting and understands social is able to target your clients with campaigns about tax and financial planning, dripping on them weekly with inarguable facts and analysis that you are not providing to them.

6557 Hits

6557 Hits

Questions?

How and why does the Advisor Products system work?

In today’s times, when consumers have become more demanding and tech-savvy, financial advisors must use content marketing to attract, inspire, engage, and convert their prospective customers.

A good content strategy is focused on developing and distributing consistent, valuable content to engage and retain prospective customers and target audience, via your website. Our content library provides financial advisors with fresh, high-quality financial content that is updated regularly, improving SEO along the way. And our automated e-newsletter and social media tools allow advisors to reach out to clients and prospects in an easy-to-use manner, providing frequent touch points for optimal brand building.

- Differentiate you from competitors

- Expose clients and prospects to your brand message more frequently

- Build an ongoing relationship with customers

- Increase your follows and fans on social media

- Drive more prospects to your website

- Help convert prospects into leads

- Increase number of pages indexed in Google

What products and services do you offer?

Can I buy services if my website is not hosted with you?

What can I expect during the onboarding process?

What if I have questions after my website is built?

Seeing is Believing.

See how easy it is to get started with our all-in-one digital marketing platform that drives leads, encourages referrals and increases client engagement.

SCHEDULE A DEMO

By using Advisor Products you agree to our use of cookies to enhance your experience I understand