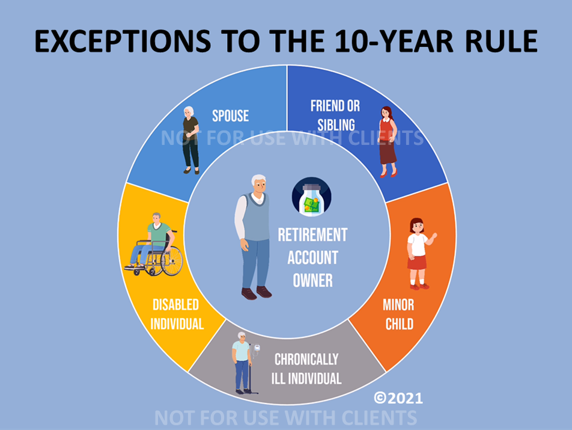

The Secure Act’s 10-year distribution rule on federally qualified inherited retirement accounts exempts widows, children, chronically ill and disabled individuals. They’re specified as “eligible designated beneficiaries” in the Secure Act.

The eligible designated beneficiaries are exceptions to the 10-year distribution rules. This is a tax break carved out for widows, children as well as chronically ill and disabled individuals. However, 401(k), IRA, and other owners of federally qualified account are the catalysts. Their qualified retirement plan assets fund a lifetime income stream for eligible designated beneficiaries, with potentially life-changing financial consequences

This is a complex topic that typically requires help from a financial professional, and it’s an opportunity for a win-win-win situation for clients, widows, children, chronically ill and disabled, as well as advisors. This two-minute video is directed to retirement account owners.