It’s unlikely you’ll see this 2019 year-end tax tip in the financial press, and it has not in the trade press currently. However, as a CFP®, CPA, CFA, CIMA® or retirement-income professional, this is probably the best 2019 year-end strategy for building your reputation as a thought leader. It's a substantive way to engage clients and prospects who are thought leaders in their chosen fields.

I’ve been writing year-end tax planning articles annually since 1983. After writing this story, it's clearly the most efficient way to help high-income pre-retirees do something to accelerate their retirement income planning. This tip is exactly what advisors should be telling clients now! Yet it is so different from year end tax planning stories before TCJA (Tax Cuts And Jobs Act).

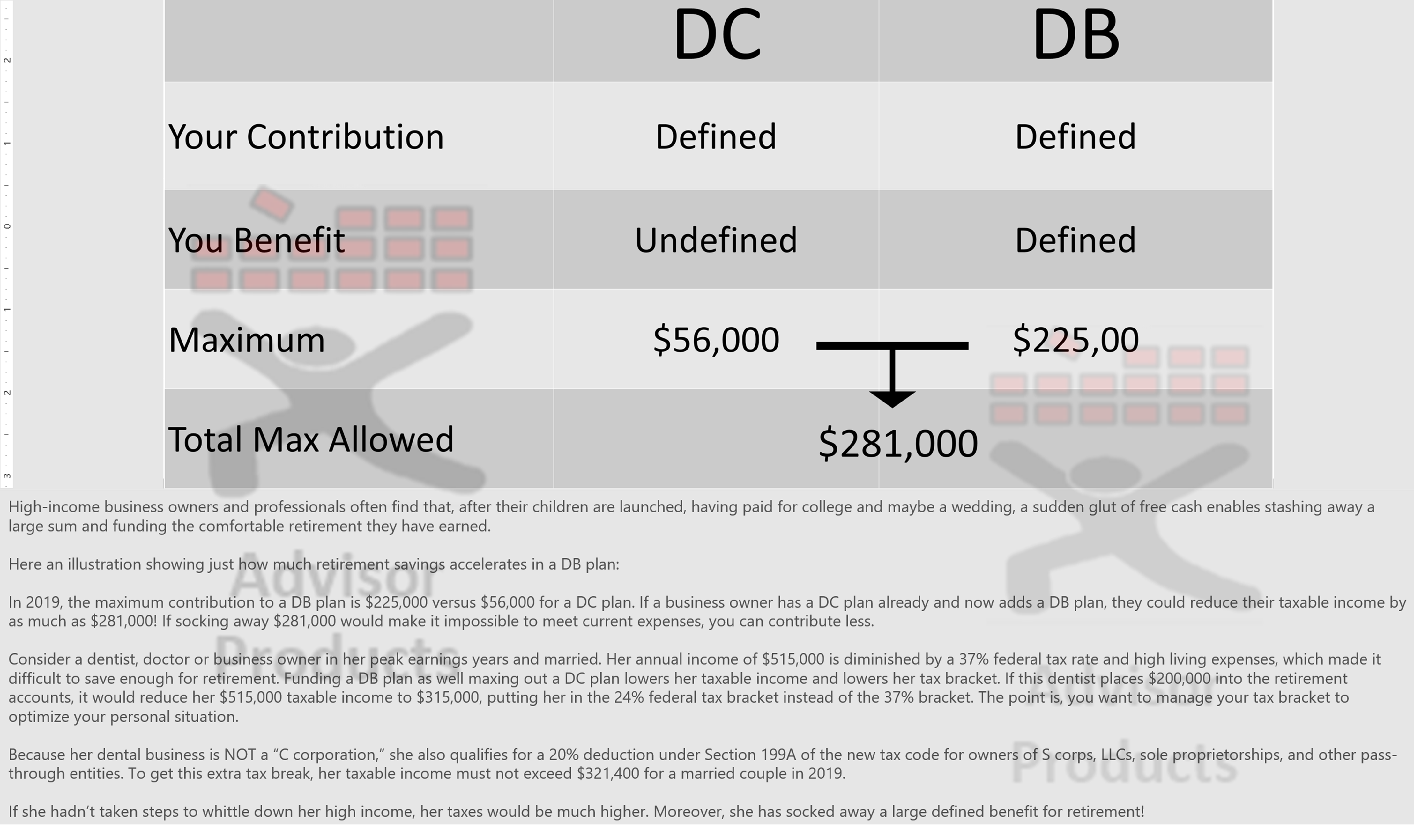

To be clear, the usual bromides for year-end tax planning no longer work in 2019. For business owners, doctors, dentists, and professionals with high-income, recent tax reforms make year-end tax planning far more complex.

The Tax Cuts And Jobs Act expanded the standard deduction, limited state and local tax deductions, added a 20% deduction on pass-through income, rendering useless the usual end-of-year tips to bunch deductions and delay income.

Want to know how you could customize this campaign to generate local leads?